Is The Parabolic Blow Off In Gold Accumulation By ETFs About To Cause A Gold Price Explosion?

Submitted by Tyler Durden on 06/17/2010 16:50 -0500

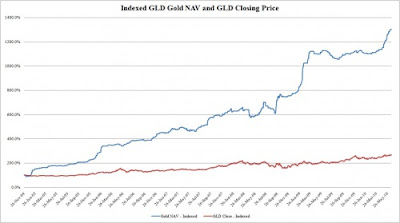

The closing of gold at an all time high price did not prevent GLD from purchasing 1.9tonnes of gold on the last 24 hours. The ETF increased its gold holdings NAV from 1306.1 to 1308. The all time record high holdings of the precious metal represent a 7.5% increase in the tonnage of gold held in the past month alone, which increased by 91 tonnes, or 7.5%, from 1217 tonnes. As the chart below shows, we have entered into a parabolic purchasing period for not just GLD, but for all other precious metal ETFs, which struggle to keep their NAV at 1. In fact, if those who claim that ETF are among the primary sources of gold demand currently, such reindexing is now creating a positive feedback loop, whereby daily record gold prices are forcing the ETFs to purchase more and more gold to retain a mandated NAV, which in turn is leading to even higher prices on the margin. The accumulation blow off phase has begun, and with a variety of ETFs announcing either shelf or follow on offerings, with the proceeds to be used to buy gold, it is only a matter of time before the actual price blow off follows. A more suitable question is why, if the purchasing of gold has picked up so much, has the gold fixing not followed?

Gold and silver are not by nature money, but money by nature is gold and silver." -Karl Marx

No comments:

Post a Comment